Wind power is weakening in some places - but not in China.

While Mitsubishi has pulled out of three offshore wind projects in Japan, President Trump is mocking wind farms as ugly bird and whale killers, causing the share price of Danish developer Orsted A/S to plummet by cancelling an almost completed project in the USA, and offshore wind farms are being stopped or postponed in Europe, things are hotting up in China. Why is that? The reasons cited in Europe and Japan are sharply rising costs, tighter supply chains and relatively high capital costs - both debt and equity - in addition to bureaucratic hurdles, very strict environmental protection requirements and political resistance.

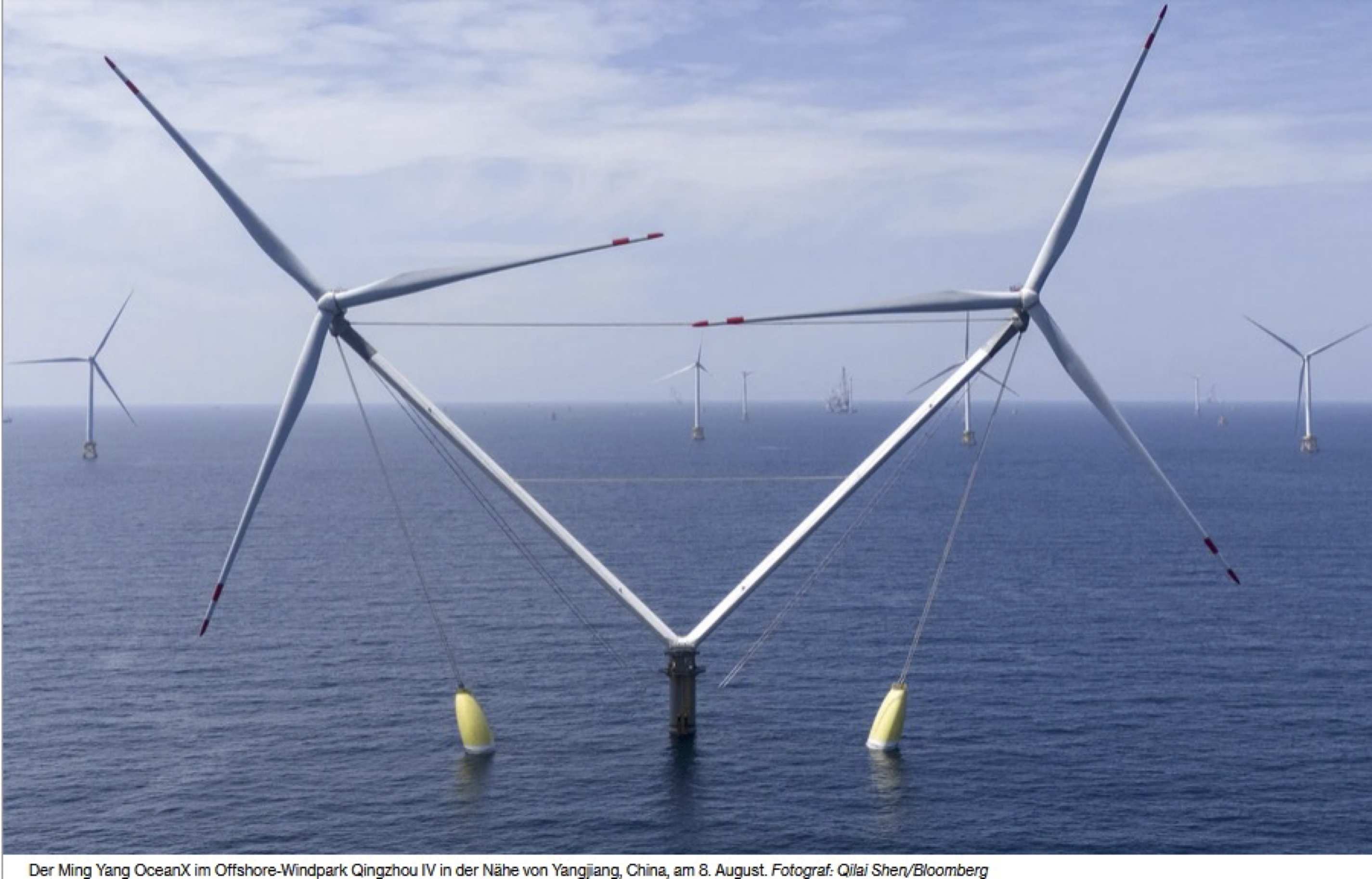

As already mentioned, things are really taking off in China - for example, a huge, double-headed turbine stands out from the "myriad" of conventional turbines off the coast of southern China - see photo.

The so-called OceanX design pushes the boundaries of what is technically feasible and utilises more wind energy than any other floating turbine in use in the world today.

Moreover, the OceanX design expresses Chinese companies' ambitions for green technology supremacy, while leading companies in Europe, the US and Japan are struggling with political and economic setbacks such as dwindling government support and limited necessary infrastructure.

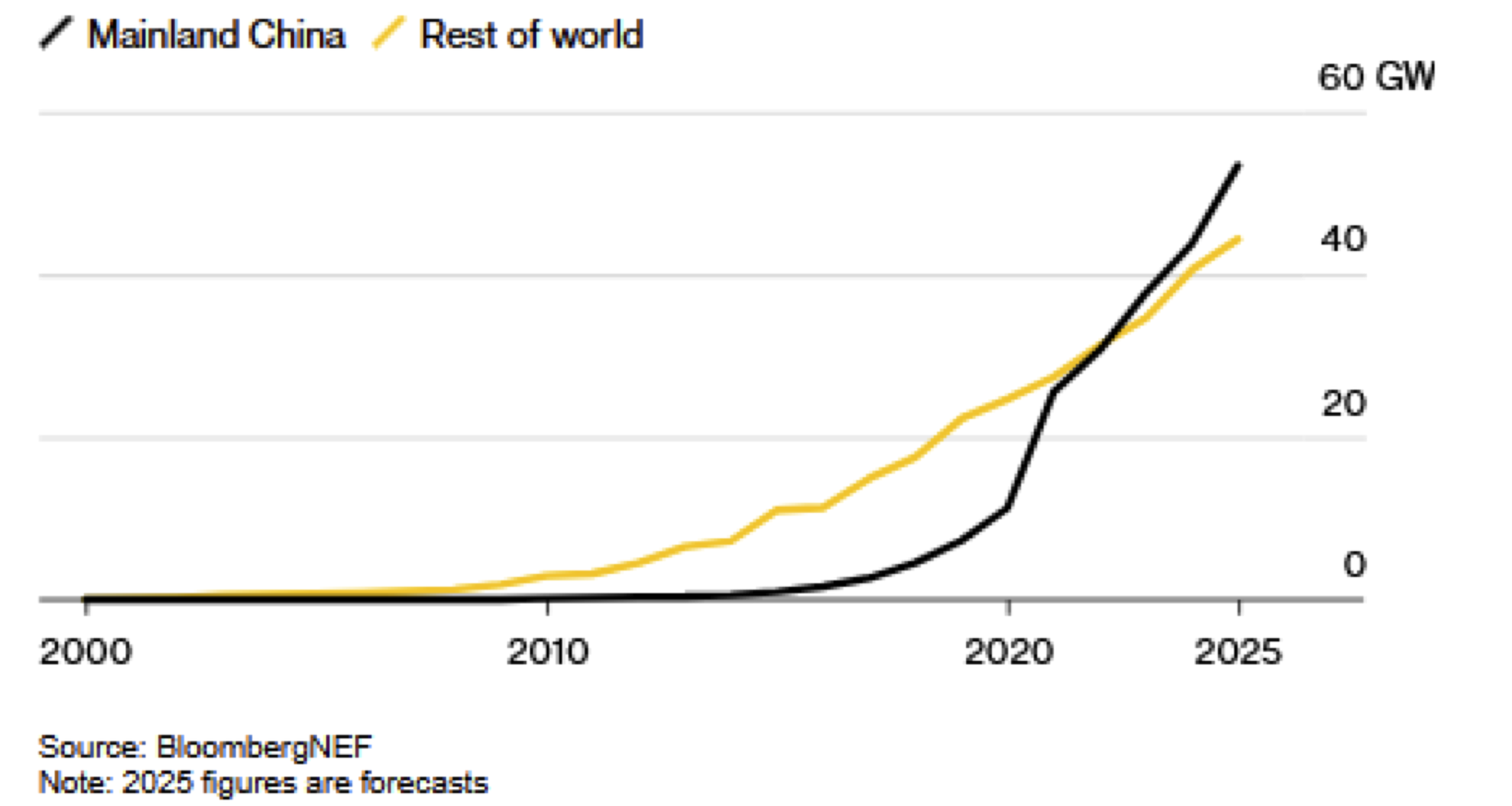

China's dependence on fossil fuel imports means that energy security is always at the forefront - hence China is a world leader in the utilisation of RES. Large-scale solar farms are being installed in deserts (western China) as well as offshore wind farms at sea, where they can utilise reliable and stronger air currents. According to Bloomberg, almost three out of four new offshore turbines installed worldwide this year will be added to the system in China.

China has thus overtaken the rest of the world in terms of offshore wind farms overall - see the following chart.

China's offshore wind farms appear to continue to benefit from advantages in financing, supply chain integration, policy support and technological improvements. China is a large and diverse market that provides all the domestic companies with the necessary platform of skills and innovation to enhance their global competitiveness to compete against industry giants such as Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA and General Electric Co.

The problems cited for Europe, Japan and the US are all too familiar to Chinese manufacturers who have survived domestic turmoil and fierce competition as the Chinese government abolished national feed-in tariffs from the end of 2021. In addition, they were and are forced to build in ever deeper waters as the number of prime locations near the coast dwindled - especially as there are military restrictions in some areas.

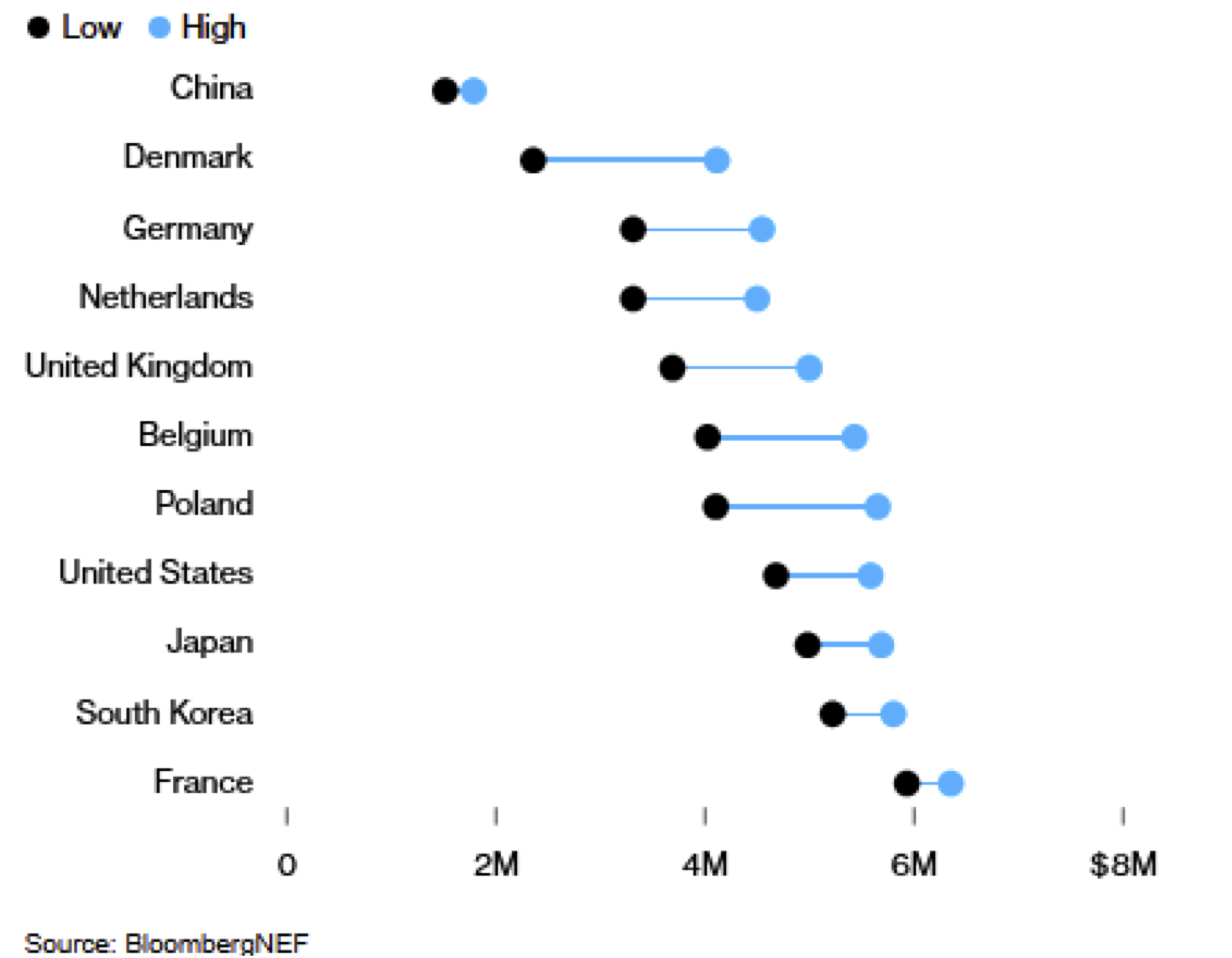

For these reasons, the developers focussed on scaling up: ever larger projects and even larger turbines. The result: clean energy for China's coastal cities and a sharp drop in prices. The average cost of offshore wind energy in China is now less than half the cost in the UK, the second largest market - see chart below. The specific investments are shown in millions of dollars per MW.

As much of the work has to be carried out close to the final installation sites, it will not be so easy for Chinese offshore wind turbine suppliers to replicate this advantage overseas - unlike other RES sectors such as solar panels, batteries and BEVs. Nevertheless, a considerable percentage of production currently goes to overseas markets such as Italy, which could increase by the end of the year.

Nevertheless, the track record will be limited - at least in the short to medium term - as foreign developers, insurers and financiers are willing to jump on the bandwagon of "very large turbines" to a limited extent - especially in regions such as Europe where there are already established players.

In conclusion, it can be said that Europe must finally get into gear - talking about this in political speeches, for example about cutting red tape, is not enough.