Secondary sanctions against China, India etc. - impact on natural gas/crude oil and oil product prices?

On 8 August, President Trump's ultimatum to Russia to end the war expires, otherwise the USA will impose additional, severe economic sanctions. On the one hand, President Trump is threatening Russia with economic sanctions - so far largely undefined - and on the other hand, countries that continue to buy Russian fossil fuels are being threatened with secondary sanctions. India is currently at the centre of these secondary sanctions. India imports large quantities of crude oil, coal and smaller quantities of LNG from Russia. In 2024, India imported around 36 billion Nm3 of LNG, with Qatar and the USA together accounting for around 50% of these imports, according to the IEA. LNG imports, which currently cover around 62% of India's natural gas consumption, are set to rise to 64 billion Nm3 by 2030.

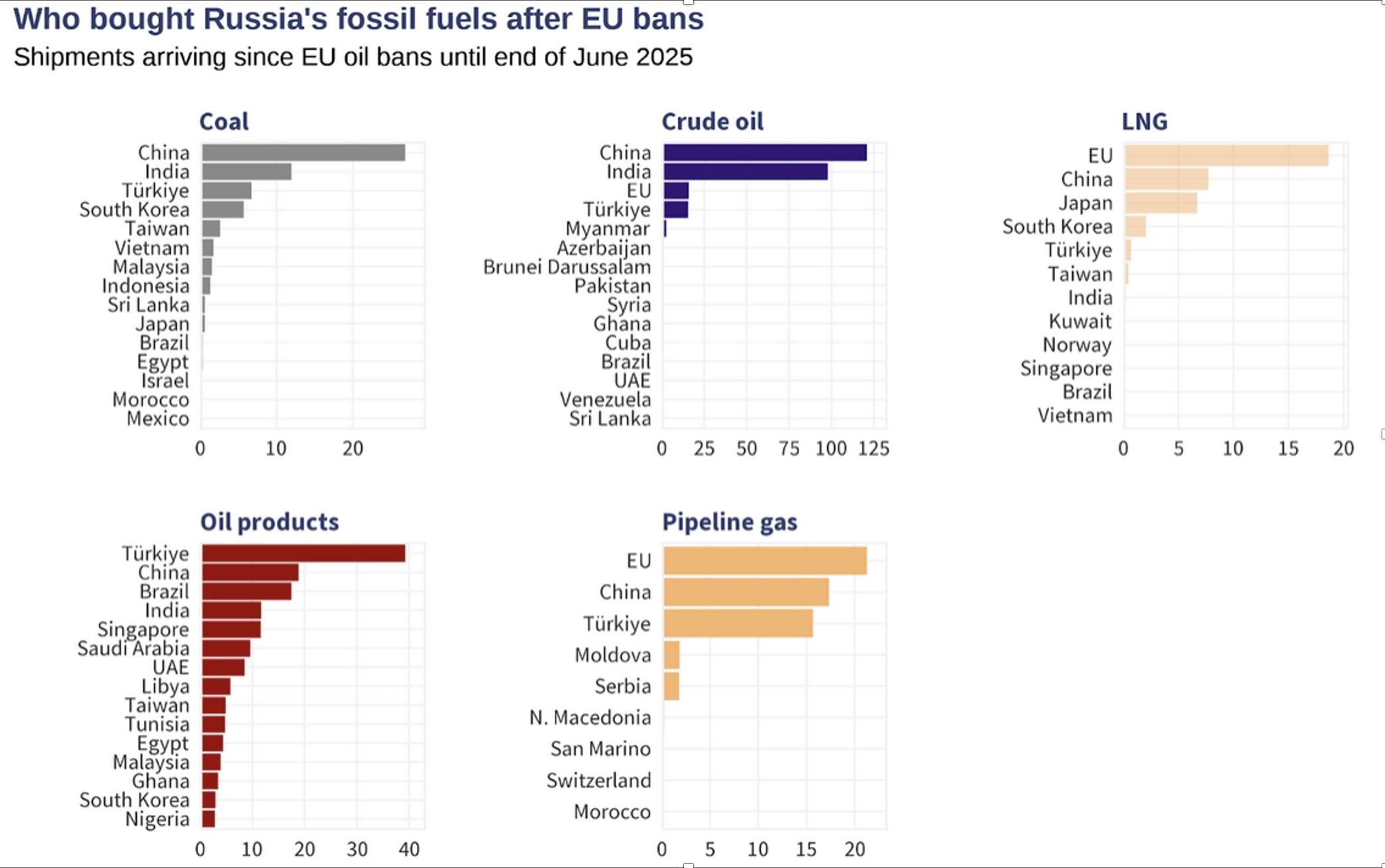

The graph below [source: Centre for Research on Energy and Clean Air (CREA) - based on data from Kpler, Marine Traffic, ENTSOG and customs data;] shows the number of ship landings (note: whether the differences in ship size have been taken into account is not disclosed - so the graphs should be read with a little caution) or the volume of piped natural gas (here it appears to be billions of Nm3) in those countries that purchase fossil fuels from Russia

If India were to stop sourcing fossil fuels from Russia due to the threat of secondary measures being enforced, this could lead to supply shortages in the tight global LNG supply, as India would have to source the Russian LNG volumes elsewhere - albeit in relatively small quantities. A similar scenario can be assumed with regard to crude oil supplies. While there was a slight price increase on the crude oil market today, but also on the oil products market, natural gas prices fell slightly on the TTF (Title Transfer Facility in the Netherlands). These price developments could indicate that natural gas and oil traders are assuming that India will not readily give in to pressure from President Trump and will therefore continue to import fossil fuels from Russia. This is probably also in light of the fact that China has not given in in the trade conflict with the USA and intensive negotiations have subsequently been initiated between the two largest economic powers - meaning that India could also consider this approach. After 8 August, there will hopefully be clarity about the sanctions threatened by President Trump asap.

It remains to be seen whether the statement by the late former US Secretary of Labour, Finance and Foreign Affairs George Shultz, which he learned at a young age and often told Ronald Reagan: "Never point your gun at someone unless you are ready to pull the trigger", will be applied here.