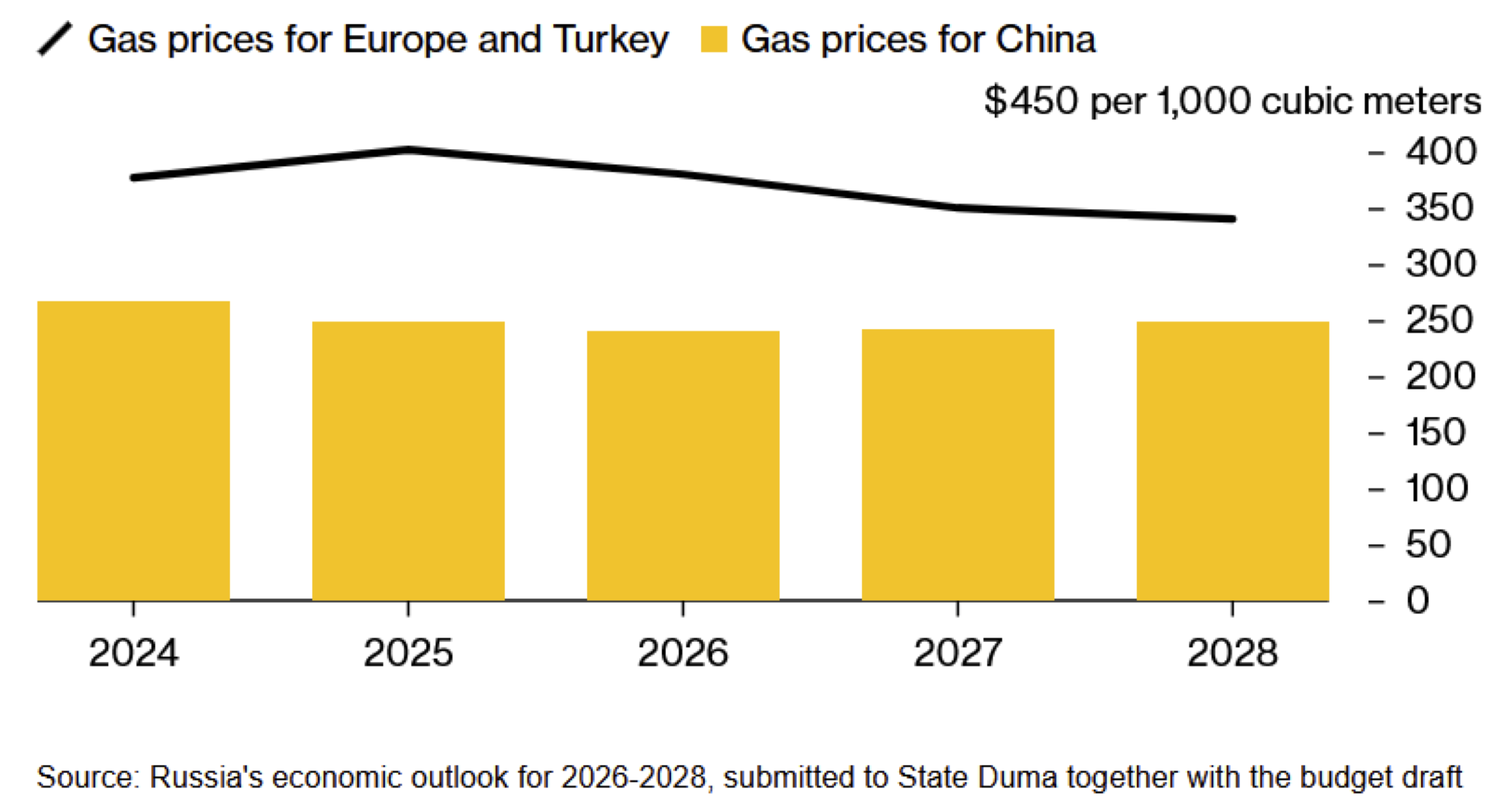

As already mentioned in the article "Power of Siberia 2 - Legally binding agreement concluded - according to Russia Newswire", China is said to have negotiated particularly favourable purchasing conditions for Russian pipeline natural gas. According to Bloomberg, the price China is expected to pay for 1000 Nm3 of natural gas in 2026, 2027 and 2028 is $248.70 (approx. €19.5/MWh at the current exchange rate to the US dollar), while export prices to Turkey and via the TurkStream to EU countries are expected to be $401.90. This means that the price of Russian pipeline natural gas delivered to China would be 27% cheaper than deliveries to the other destinations mentioned. In 2025, the price of Russian natural gas delivered to China is even expected to be 38% lower compared to the other destinations - see the following chart.

This price difference is also objectively understandable due to the shorter transport distances to China - compared to the other export destinations - according to Mr Alexey Miller, CEO of Gazprom according to Interfax (for distance estimates, see inserted chart taken from ICIS)

The prices mentioned suggest that the specific profits that Russia achieves with natural gas deliveries to China are significantly lower than those with the remaining deliveries to the EU or Turkey.

If the purchase flexibilities for the current pipe natural gas deliveries to China are large - as is assumed for the planned Power of Siberia 2 and the Eastern Link, which is currently in the construction phase and is scheduled to go into operation in 2027 - China could import more or less gas from Russia via the pipelines depending on demand - depending on global LNG market prices - and divert LNG shipments intended for China to Europe. This approach would also allow China to exert pressure on global LNG market prices - to the benefit of other LNG purchasers and, of course, to the even greater advantage of China and its companies.