China's energy policy may lead to further falls in natural gas prices

The commissioning of additional LNG liquefaction plants ("LNG Wave") expected for 2025 (in Q3 and Q4) but also in Q1 2026, as well as the development of the global economy, will put pressure on gas prices for the winter of 2025/2026 and beyond - but also for the upcoming natural gas storage refill. Could these prices still fall - with a focus on the 2025 storage refill period - and if so, why?

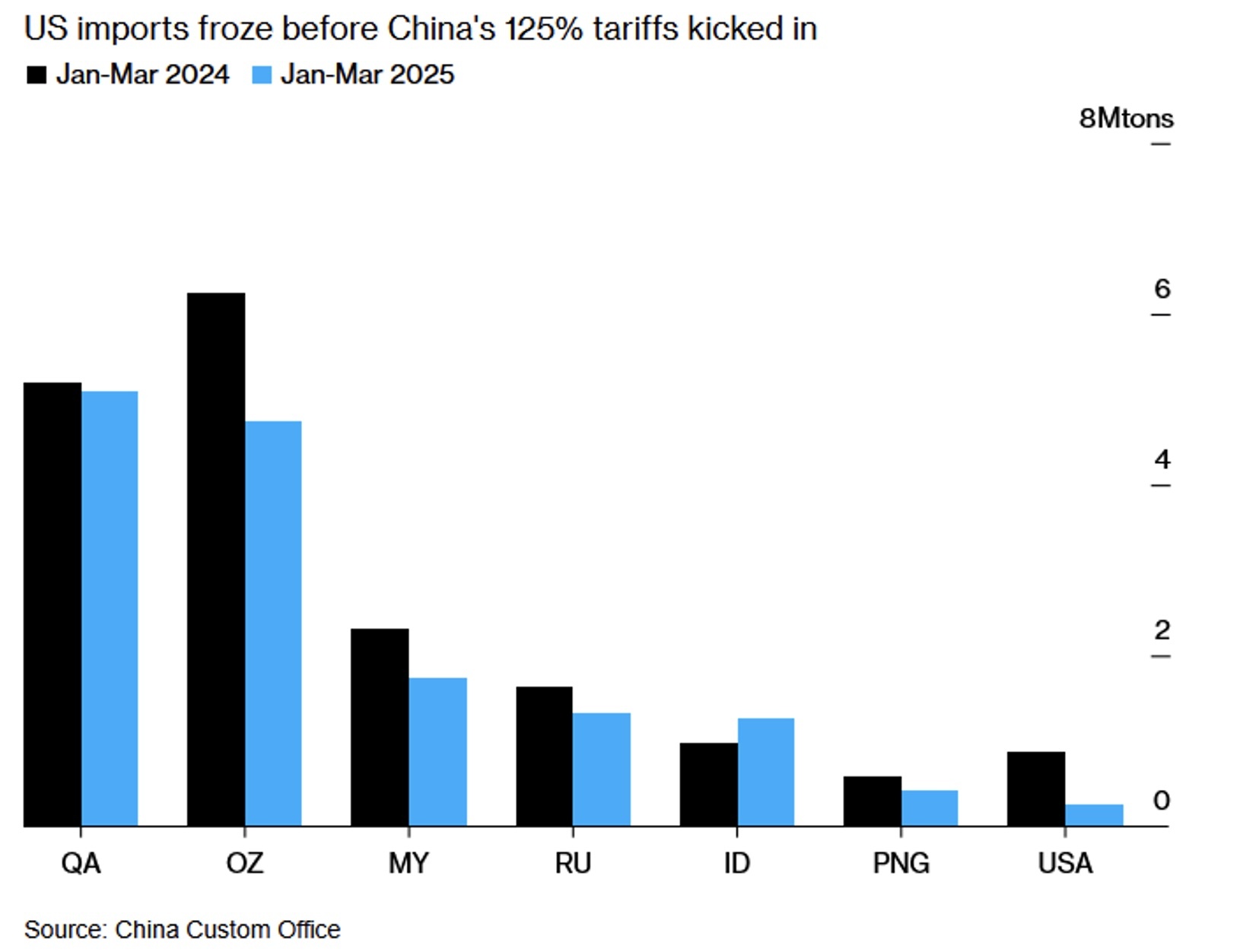

China, a major LNG importer with a large US share of these LNG imports, has significantly reduced LNG imports from the USA in Q1 2025 compared to Q1 2024. This was before the so-called "Liberation Day" - with a focus on import tariffs to the USA - was announced by the Trump administration on 2 April and before China responded with countermeasures (tariff on LNG imports from the USA 125%). After LNG import volumes from the US had already been significantly reduced in January and February, no LNG was imported from the US to China at all in March 2025. In total, the reduction in LNG import volumes from the USA in Q1 2025 - compared to Q1 2024 - was around 70%; see chart below.

LNG import volumes from other LNG-exporting countries fell for five consecutive months compared to the same period last year and "plummeted" by 24.5% in March 2025. This means that China has not switched to other LNG suppliers, but has made up for the overall drop in LNG consumption by:

- the increased use of coal and RES - also from a security of supply perspective - and

- a relatively small increase in pipeline imports (the increase in pipeline imports relates to the volume of natural gas imported from Russia)

against the backdrop of a somewhat warmer winter compared to 2023/2024 and relatively weak economic growth - also resulting from the trade war with the USA, which was already foreseeable or had already begun in the aforementioned period, instigated by President Trump. According to BloombergNEF, a prolonged trade war could lead to a slight increase in natural gas consumption in China but remain below forecasts and LNG imports in 2025 could be reduced by a total of around 12% compared to 2024 - as a result, the tight global LNG market could be "relieved" by around 13 billion Nm3. This could lead to price reductions. It remains to be seen how long the suppliers/traders will wait with the intensive refuelling of storage facilities - with a view to possible price reductions.