What are the details and how realistic are certain planned orders of magnitude?

As already described in the article from 31 July 2025, the EU had to assure the USA that it would import energy and nuclear technology to the tune of €700 billion by the end of 2028 in order to reach a trade agreement with a tariff of "only" 15%. The European Commission (EC) has now "explained" the details of this "deal" - including in the energy sector.

It should be noted at the outset that it is clear to interested readers that the justified motivation for the withdrawal from Russian fossil fuels is to reduce the sources of funding for the Russian war of aggression against Ukraine. It is also clear to this readership that President Trump loves grand appearances and likes to be flattered (keyword "flattery diplomacy") - against the background that the EU does not want to upset or even lose the USA as an ally.

According to the EC's answer to the question "How were the commitments regarding the purchase of energy or AI chips calculated?" posed on 21 August 2025, the details in the energy sector are as follows:

The EU wants to ensure a secure supply of strategic inputs from reliable partner countries, including the USA. In recent years, the USA has become an important supplier of energy products. Last year alone, the EU purchased energy sources - primarily gas and oil - worth around 70 billion euros.

The EU therefore intends to procure US liquefied natural gas, oil and nuclear products with an expected purchase volume of 750 billion US dollars (approx. 700 billion euros) over the next three years. This is intended to help replace Russian gas and oil in the EU.

The actual purchases will not be made by the EU or the European Commission itself. Rather, the Commission is taking on a supporting role to ensure that the member states have sufficient energy resources.

In addition, the EU plans to purchase €40 billion worth of AI chips - these are considered crucial to maintaining the EU's technological edge. This commitment is fully in line with the EU's digital strategy. The EU is investing in the development of so-called "AI factories" across Europe to ensure secure and uninterrupted access to the high-tech chips produced by the US.

The deal involves the acquisition of LNG, oil and nuclear technology, including small modular reactors (SMRs), totalling approximately €230 billion per year - assuming an even distribution of the approximately €700 billion envisaged in total over three years.

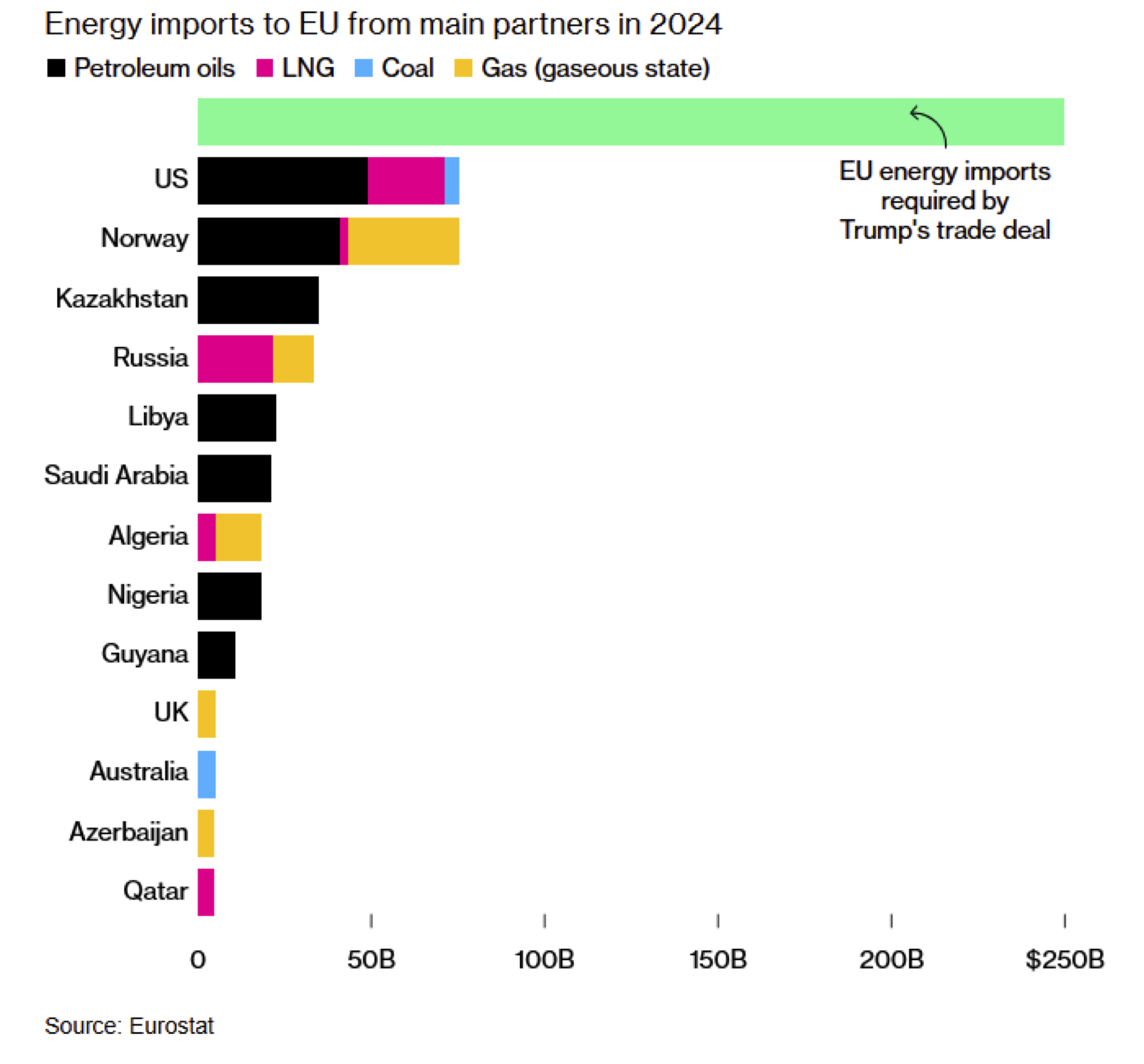

This figure, namely approx. € 230 bn/year, does not seem plausible, but far too high - if you look at the data from Eurostat - see the chart below (figures in $).

Energy imports from the USA currently amount to around € 70 billion per year. If imports from Russia - which currently amount to around € 29 billion per year - were to be replaced by imports from the USA, this would amount to around € 100 billion per year - a far cry from € 230 billion per year - especially as there are plans to reduce natural gas and oil consumption in the EU in the future. 130 billion per year can hardly be made up by nuclear technology - with a focus on SMRs - especially as the technology is not yet ready for the market and may not be fully developed by the end of President Trump's term of office. Not to mention the pre-planning requirements for such reactors. Even if the necessary commercial readiness level (CRL) of these small modular reactors were to be reached in the near future, their implementation would not be worth the equivalent of € 140 billion annually. This is because the period until the end of 2028 is simply too short for the construction and deployment of a large number of SMRs. Even if you were to add the AI chips, you would still be very far away from a total of € 700 billion by the end of 2028.

This deal could be partly at odds with the intended diversification policy and efforts towards climate targets. With regard to diversification efforts, a distribution of energy imports across several countries is recommended - one newer knows. With regard to climate policy, it should be noted that the LNG originating from the USA is mainly liquefied natural gas, which is obtained by fracking and produces higher CO2eq emissions than natural gas obtained by conventional methods. Not to mention the ship transport emissions and the additional, unavoidable boil-off rates "achieved" there - compared to natural gas transported in pipelines. The latter also occur with LNG imports from other countries, such as Algeria or Qatar, but the transport distances are somewhat shorter.

As the EU, according to its own statements, is "only" supposed to play a supporting role, the question arises as to which companies should buy the energy or nuclear technology at all. It is not clear from the announcement or the EC's response whether any preliminary talks/agreements have been/are being held with relevant European companies. It is not known whether the EC is currently considering any incentives for such companies. If it does, questions could arise as to their admissibility. Even if the argument of "overriding interests" is put forward.

Somehow the "deal" presents itself as a kind of declaration of intent - involving personal vanity.