Fairy tales and alternative truths are notoriously popular in politics. Does this also apply to energy policy?

Given the occasion - see ORF Sommergespräche, but also statements to this effect in a relevant interview with the Neue Zürcher Zeitung (NZZ) - this article once again addresses the myth of cheap Russian gas and its political instrumentalisation. In many statements - especially political statements - one often hears that the "cheap" Russian gas has contributed to the positive economic development in Europe, primarily Germany and Austria. Austria became or still is virtually "addicted" to cheap Russian natural gas - and now the loss of Russian natural gas has fuelled and continues to fuel natural gas prices and consequently also inflation in Austria, thus endangering the competitiveness of the Austrian economy - at least of those sectors that require natural gas - either as fuel or product input - on a large scale. How are these statements to be interpreted - apart from the political intention to justify the Austrian inflation rate, which was and is well above the EU average, in order to make political capital out of it?

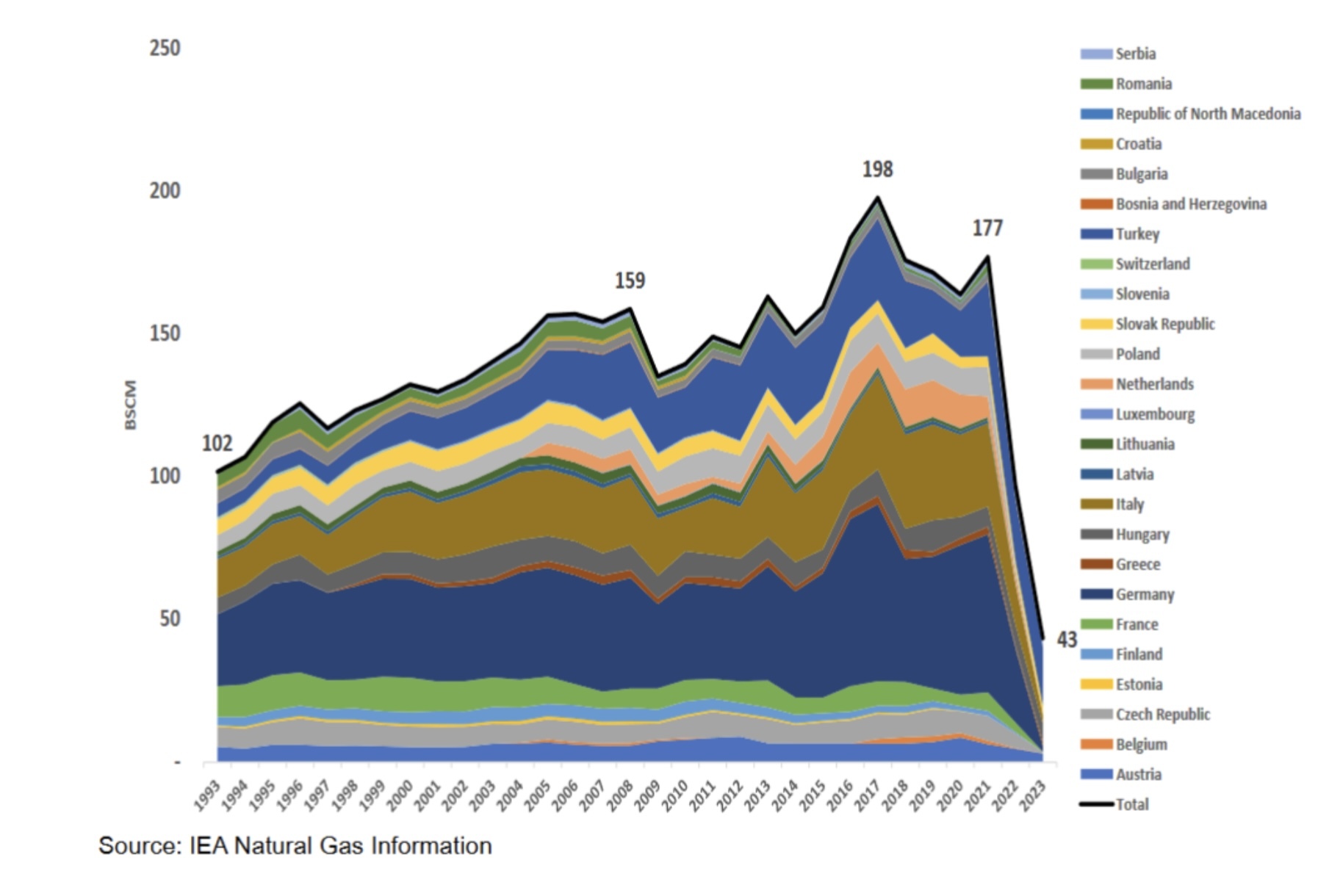

What is undoubtedly true is that the volumes of Russian natural gas supplied to Europe have risen sharply over time - at least until 2021 - as can be seen in the following chart "Natural gas - pipeline imports from Russia". Imports have risen from approx. 100 billion Nm3/year in 1993 to approx. 200 billion Nm3 in 2017 - with Germany as the largest importer. Naturally, supplies from the Russian Federation - together with imports from Norway, the Netherlands, etc. - have kept supply high. - have consequently kept natural gas prices low.

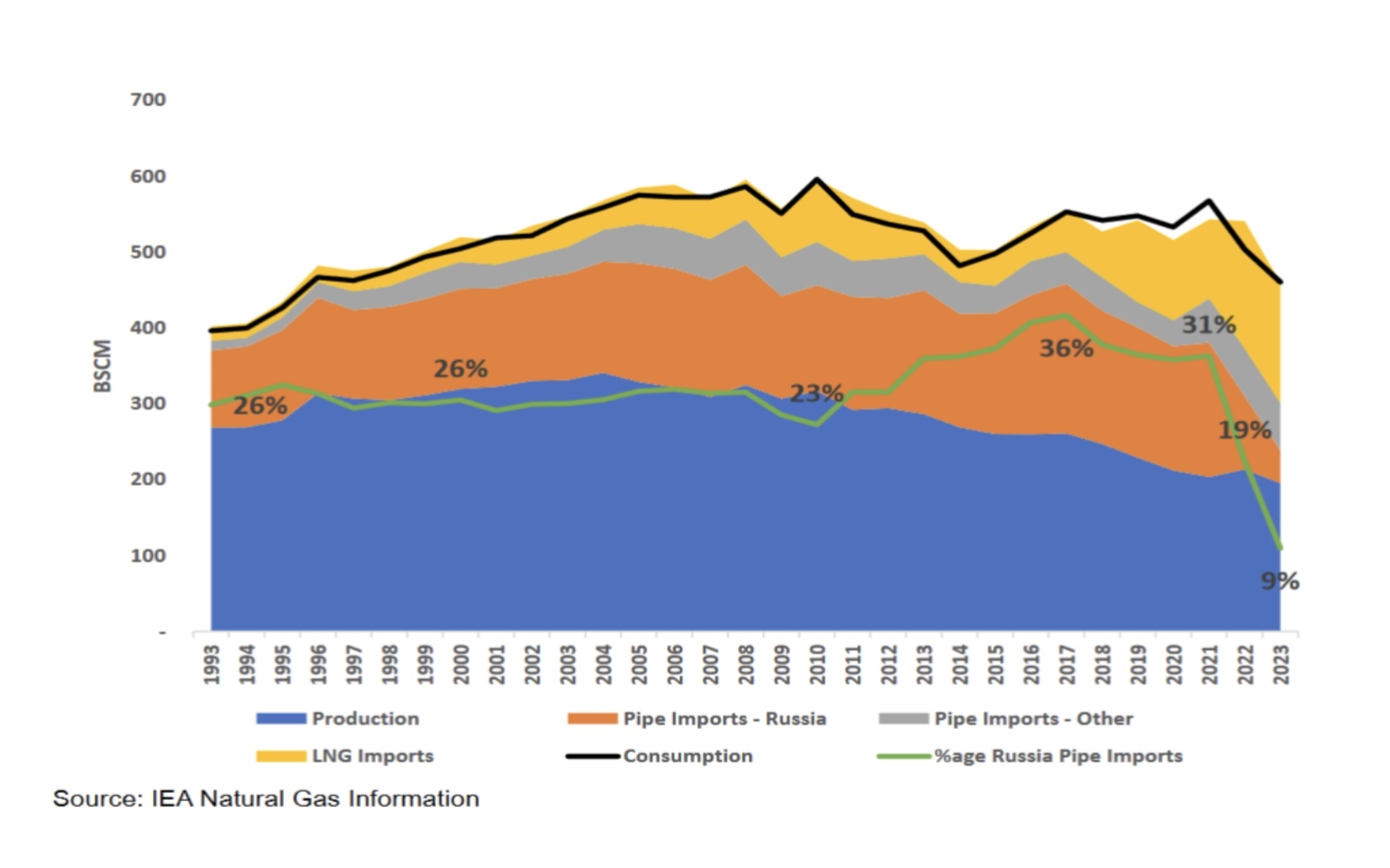

The following chart "Supply and demand balance for Europe" shows the proportion of different supply sources.

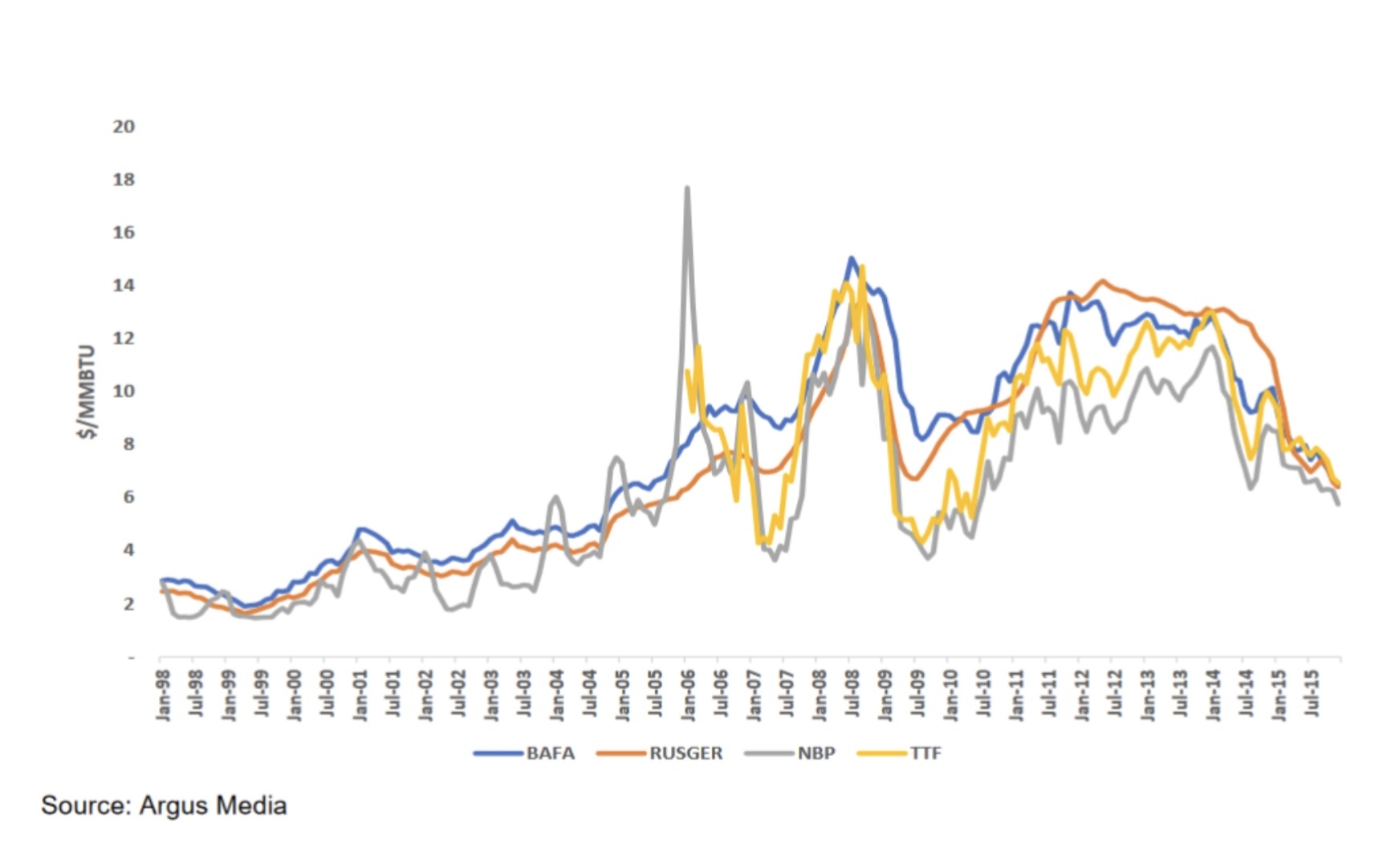

Originally, the long-term contracts (LTCs) for natural gas supplies to Europe were predominantly oil-indexed. In the mid-2010s, the switch to hub-based prices took place. The development of prices is shown in the following chart, which shows the BAFA (weighted average import price to Germany, a mix of imports from Norway, the Netherlands and Russia), RUSGER (price of oil-indexed Russian gas delivered to Germany), National Balancing Point (NBP) and TTF price over time.

It can be seen that the NBP price and, since 2006, the TTF price were generally slightly lower than the BAFA and RUSGER price until 2008. From 2009 - 2014 the spot prices were significantly lower than the oil-indexed prices. These facts ultimately led to changes in LTCs, with hub-based pricing - one of the core concerns of natural gas market regulation - prevailing. In other words, the price of Russian gas until the switch to hub-based prices was not lower from the buyer's perspective, but on average slightly higher than the price of gas traded on spot markets. After the switch to hub prices, the price of Russian gas was determined on a hub basis, just like the other supply sources, and all participants were price takers in a liquid market. The relatively low hub prices at that time were therefore the result of gas-to-gas competition - especially as the obligation to honour take-or-pay (ToP) contracts increased the volume of natural gas offered in some cases (contractually agreed minimum volumes had to be taken or at least these minimum volumes had to be paid for) and the elimination of the destination clause enabled cross-border competition. In other words, since the hub-based pricing of natural gas, it is by no means possible to speak of "cheap Russian natural gas" - especially as the prices in Austria were usually slightly higher than the TTF prices. This also means that the argument that the elimination of "cheap Russian natural gas" has significantly driven inflation in Austria above the EU average is not correct.

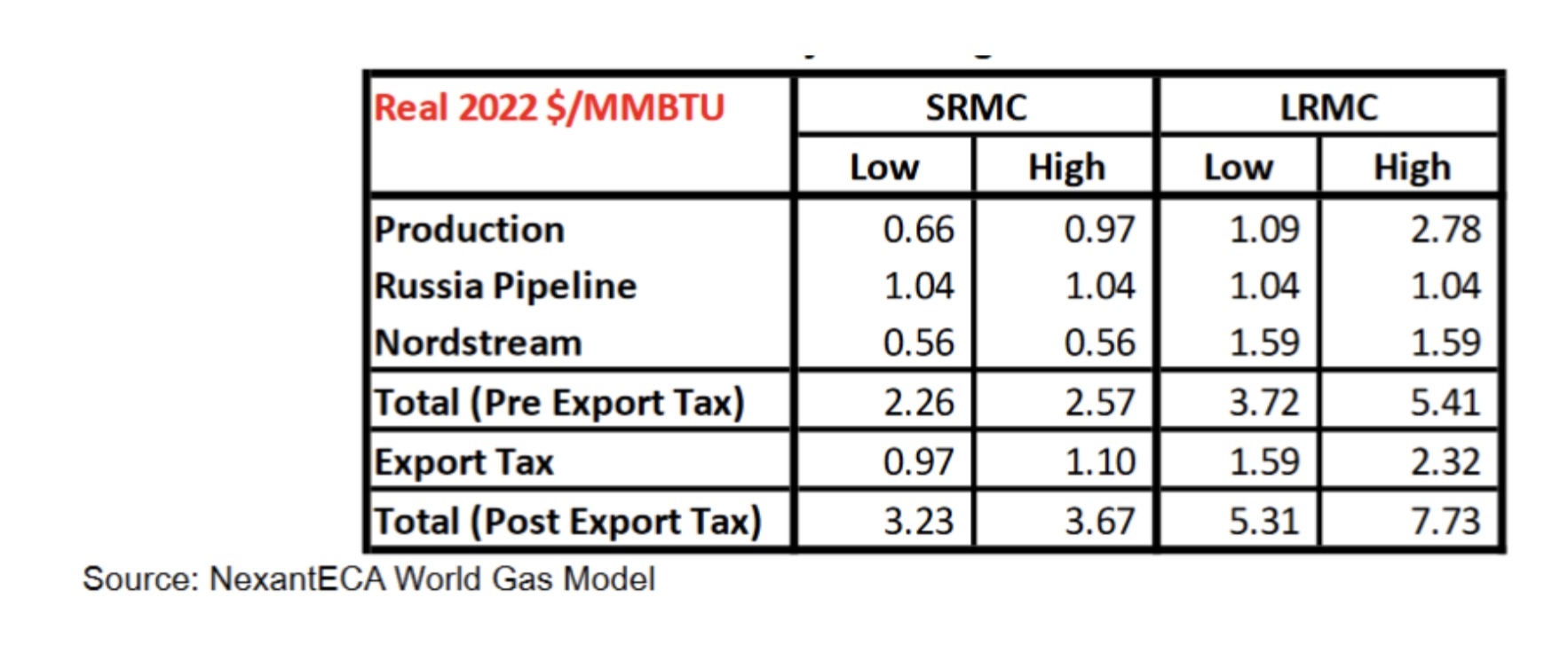

It may be that the production and transport costs of Russian natural gas were low, but not the prices that buyers in Europe had to pay for it. See presentation of the estimated cost components of Russian natural gas - differentiated between short-run marginal cost (SRMC) and long-run marginal cost (LRMC).