Anticipating peace in Ukraine too soon?

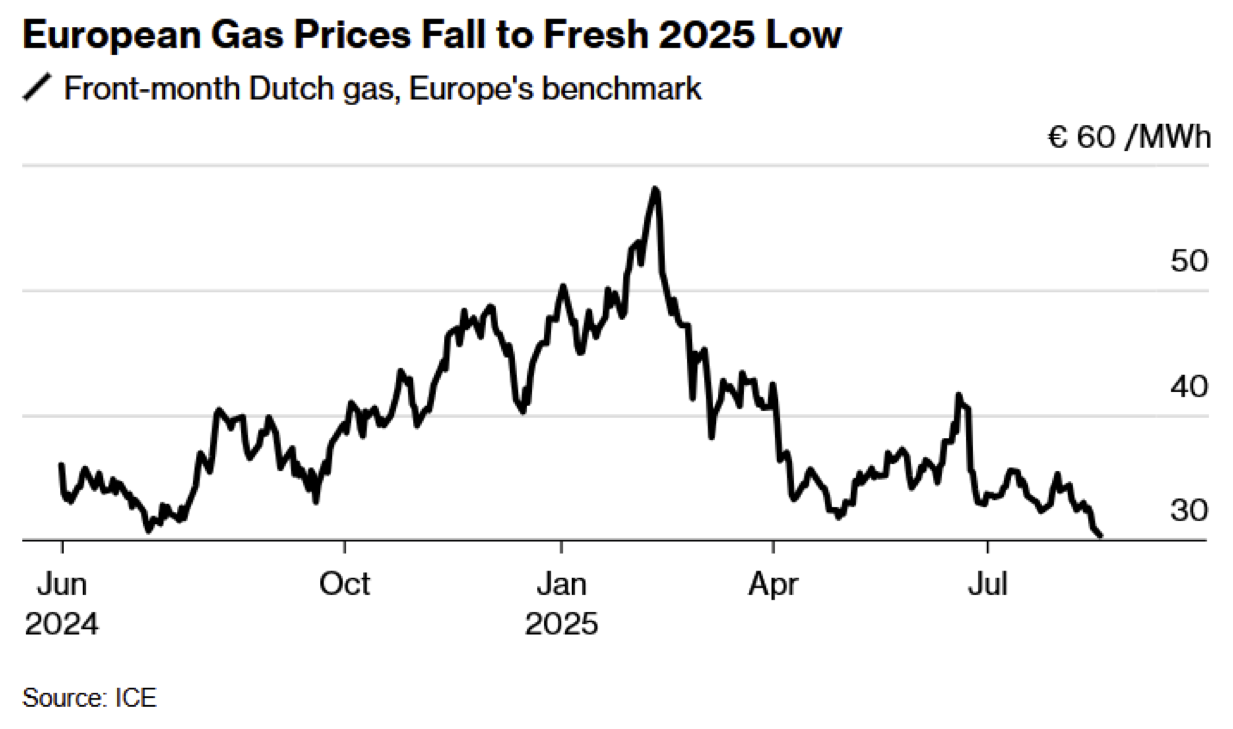

The gas price (front month) was quoted at a 2025 low of € 30.4/MWh on the TTF (Title Transfer Facility) yesterday (see chart below). Prices turned around again today. Apparently, natural gas traders assessed yesterday's meeting between President Trump, President Zelensky and representatives of Ukraine's European allies as too promising in advance in terms of progress towards ending the Russian war of aggression and the resulting potential impact on the price of natural gas.

In other words, the assumption that Russian natural gas supplies would find their way back to the EU was obviously overestimated - especially as the increase in these imports should have happened relatively quickly.

What were and are the technical, economic and political conditions that led to yesterday's downward movement in natural gas prices?

The EU is phasing out imports of natural gas from the Russian Federation at the end of 2027 - so an increase in imports would - at least to a large extent - mean a departure from these EU targets.

From a technical perspective, a rapid resumption of natural gas transit through Ukraine seems rather unlikely - even if Ukraine would/must agree to such an arrangement - as the transit pipeline system in Ukraine would probably have to be overhauled and partially repaired first.

The two Nordstream 1 pipelines and one section of Nordstream 2 are badly damaged. Repairing these pipelines would entail high repair costs and take many months. Even if the repair were economically viable - which is to be assumed - extensive planning work, the ordering of long lead time items and the scheduling of pipe-laying vessels - which are usually scheduled for very long periods of time - would be necessary.

As the commissioning of Nordstream 2 has not yet been authorised and this would be a lengthy process (resistance to commissioning would be expected from many sides), even the undamaged Nordstream 2 line could not be commissioned in the short term

If we assume that the existing and planned natural gas supply structure of the EU will not change quickly, then the LNG natural gas volumes from Russia offered on the global market (the pipeline capacities - for example Power of Siberia 2 - cannot be increased in the short term) would have to increase compared to now in order to be able to push LNG prices down. This would be possible if Russia were put in a position to quickly increase the expansion of liquefaction capacities north of the Arctic Circle - including "free passage" for the sanctioned LNG tankers.

Whether such signals could be derived from the Alaska meeting remains questionable. Was the wish the father of the thought?