Trading Hub Europe, market area manager in Germany, is discussing with the German regulator the possibility of a subsidy to incentivize the refilling of natural gas storage facilities in spring/summer/autumn 2025 - see below for details.

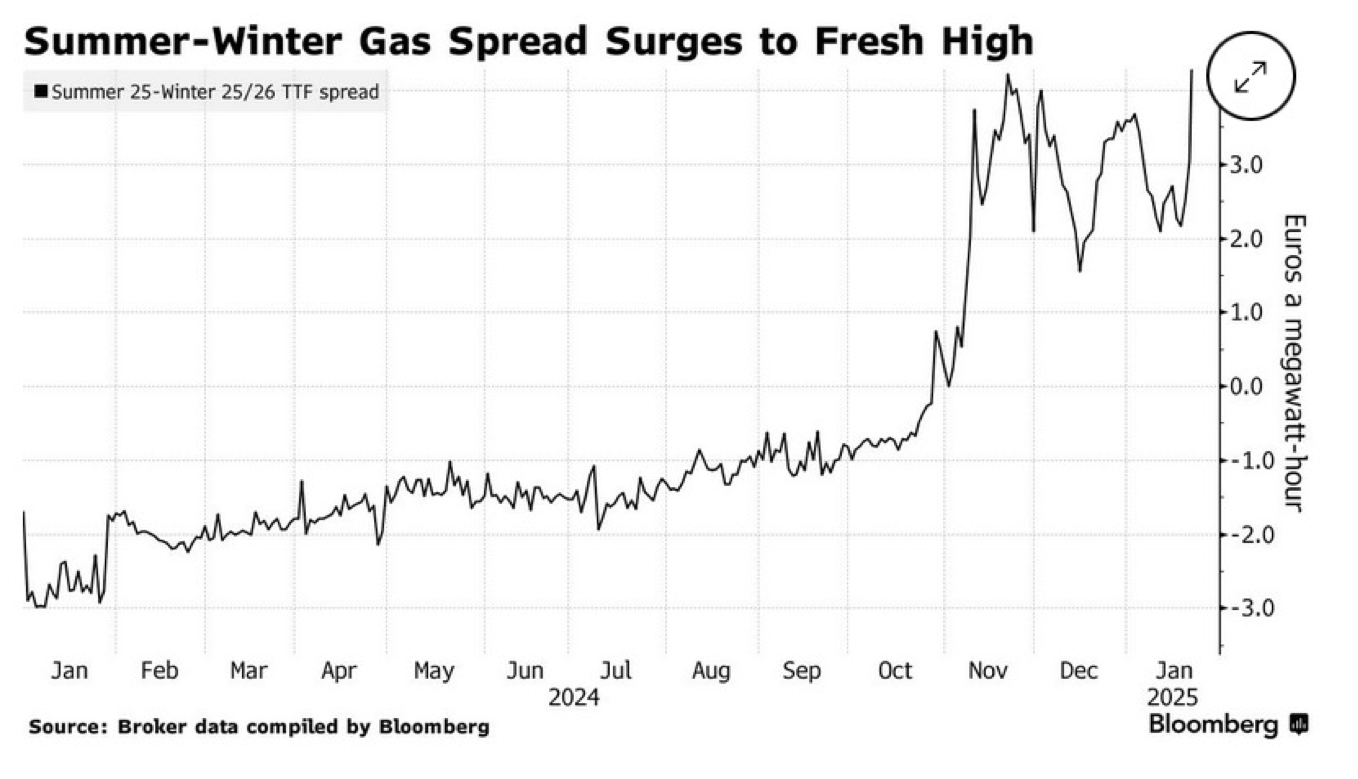

The summer-winter spread has risen recently - doubling in the last two days and reaching up to € 4.85/MWh, as shown in the chart below, taken from Bloomberg. According to experts, market interventions/announcements of this kind are "fueling" the price. The more states intervene, either through subsidies or penalties, to refill storage, the more the price signals are disrupted which usually encourage companies to book storage capacity that will be used.

Hedging costs against price increases for the natural gas required for refilling are also rising. In the meantime, natural gas traders are monitoring the development of the weather in the USA - along with the resulting potential effects. For example, the Freeport LNG liquefaction plant had to suspend operations due to a lack of power supply. Natural gas traders are also concerned that President Trump may impose additional sanctions on Russian LNG liquefaction plants and that this could have a negative impact on the already tight LNG market.

The proposal regarding subsidies for natural gas storage refilling is as follows.

- In order to achieve the legally defined storage filling levels - despite unfavorable framework conditions - offers for the storage of natural gas are to be obtained.

- natural gas should be obtained.

- Subsidies are to be granted to suppliers if the seasonal spread is smaller than that offered.

- Subsidies are to be capped - whereby the final calculation and any resulting payments are not to be made until November 1, 2025.