In addition to the IEA, which pointed out the shortcomings in the H2 ramp-up as early as 2023, the European Court of Auditors (ECA) criticised the lack of sound analyses in 2024 for setting production and import targets of 10 million tonnes per year (Mtpa) of renewable hydrogen (H2) by 2030 - i.e. a total of 20 Mtpa. As part of its counter-strategy to block Russian fossil fuels following Moscow's invasion of Ukraine in 2022, the EU has adopted overambitious H2 targets. According to the ECA, these are based neither on existing capacities nor on a realistic development path. The ECA report also states that the legal framework for EU climate policy was adopted too quickly and is far too bureaucratic, complex and lengthy for the implementation of European H2 legislation. The ECA called on the European Commission to review the H2 strategy, explaining the role of H2 imports and their potential role.

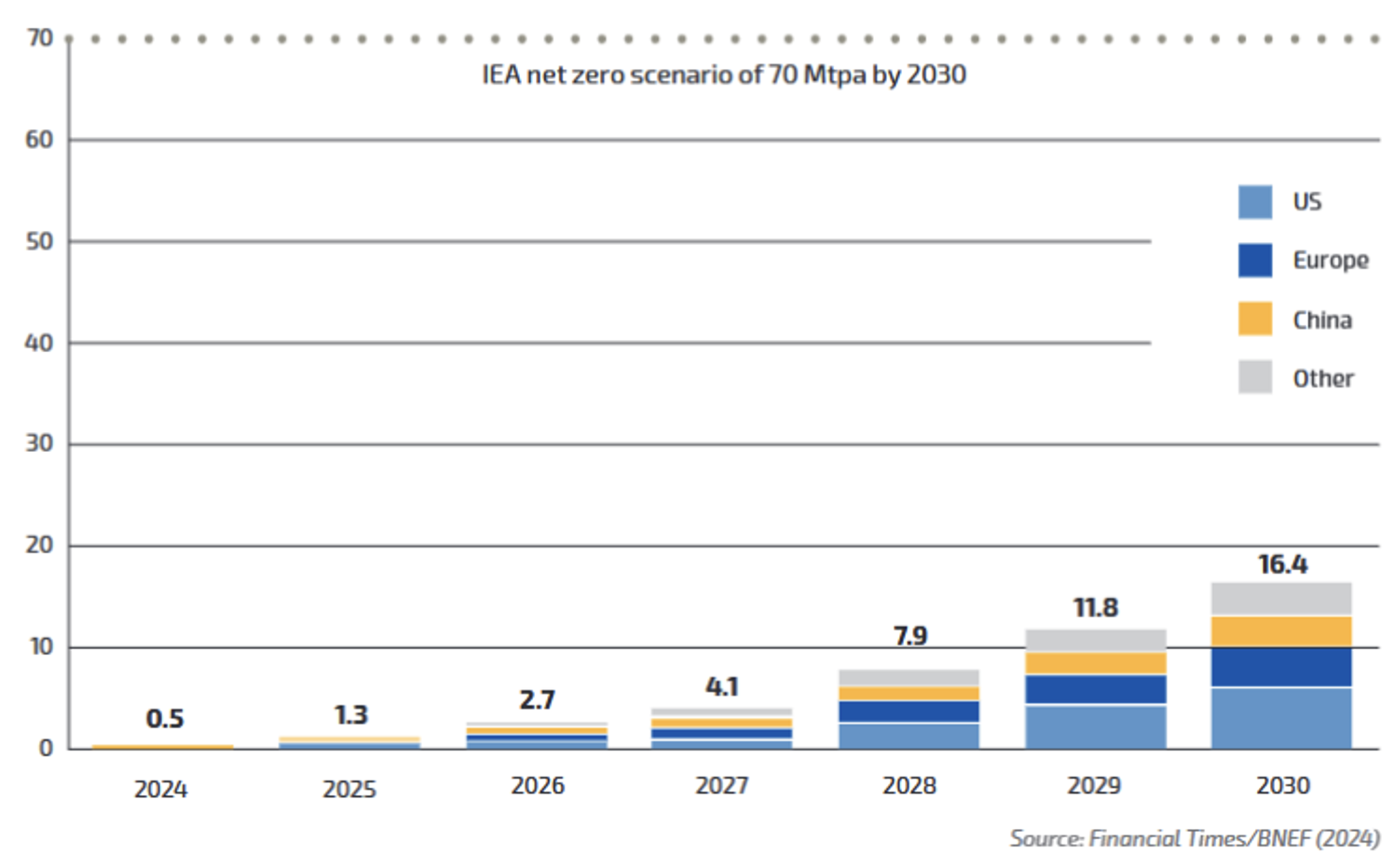

In addition, Bloomberg New Energy Finance (BNEF) recently admitted that its previous analyses significantly overestimated global H2 demand. Instead of the previously forecast 500-800 Mtpa by 2050 to reach net zero, BNEF now reduces the demand to around 390-450 Mtpa. Latest BNEF analyses show that the achievable global H2 production capacity in 2030 is likely to be around 16 Mtpa. instead of the previously stated 70 Mtpa. According to the IEA, government measures and targets will lead to H2 utilisation of 11 Mtpa. by 2030 due to downward adjustments for H2 utilisation (mainly broader and deeper electrification).

The developments according to BNEF can be seen in the chart below, which also includes the net zero scenario with 70 Mtpa by 2030.

In its latest cost forecasts, the BNEF assumes a tripling of the original production cost estimate by 2050 - due to higher costs for electrolysers and other equipment. The predicted higher costs for the production of green H2 will make the decarbonisation of "hard to abate" sectors even more difficult without higher subsidies or other incentives. Only green H2 produced in China and India is considered competitive.

What are the implications for Austria? The ÖNIP, which has already been justifiably criticised several times in this medium, needs to be updated. The H2 projects contained in the ÖNIP result from an H2 requirement that was estimated in the "H2 hype" era - based on non-binding enquiries and without taking into account the realistic willingness to pay of the (industrial) companies contacted. This approach obviously led to greatly inflated expectations regarding the H2 ramp-up.

An efficient investment requires not only an adequate dimensioning of the infrastructure - including compressor station(s) and H2 storage, which are not yet included in the first ÖNIP, but also a timely, i.e. not too early, implementation of the relevant projects in order to keep the capital costs (equity and debt capital) low.

There is a lot to do - let's not leave it lying around, let's get on with it - to paraphrase a former Shell advert.