An analysis

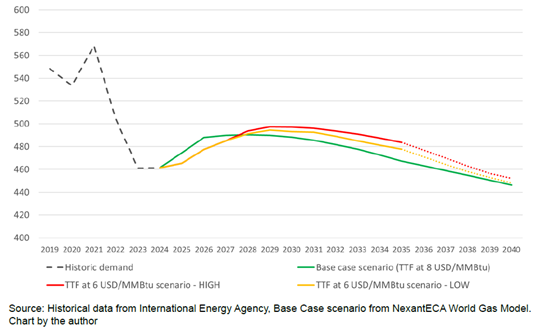

Due to the long-awaited or announced LNG wave, the global LNG supply could exceed the demand for LNG by 2030 and lead to wholesale prices that are more likely to be orientated towards < € 25/MWh instead of > € 30/MWh from 2028 - 2030. The study "The Global Outlook for Gas Demand in a $6 World" - prepared by the Oxford Institute for Energy Studies (OIES) - asks what short-term and long-term effects such a price reduction could have on gas demand - with a focus on Europe.

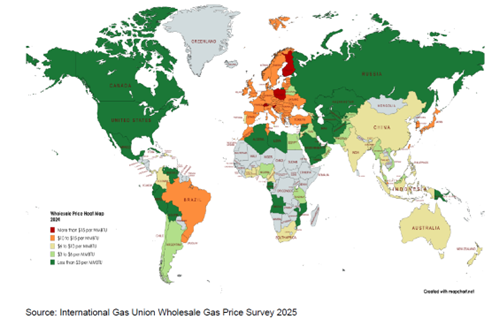

The global wholesale price situation is currently as shown in the map below.

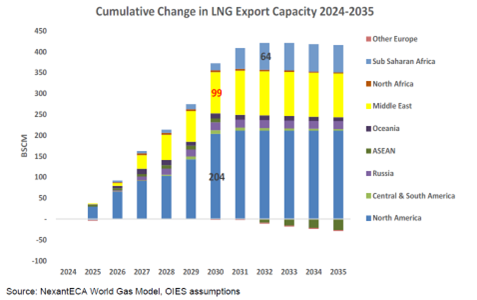

The cumulative additional global liquefaction capacity up to 2035 is shown in the following chart.

What effects on the demand for natural gas are to be expected in Europe under the following framework conditions?

Coal-fired power plants have already been partially decommissioned - additional decommissioning is to be expected - although there could be delays in individual decommissionings - more likely would be - but the deadline for the 100% phase-out of coal would be met. Natural gas would be used as a backup for RES;

The expansion of offshore wind farms is not taking place on time as the component and other costs - and consequently the investments - for this type of RES have risen sharply and will continue to rise;

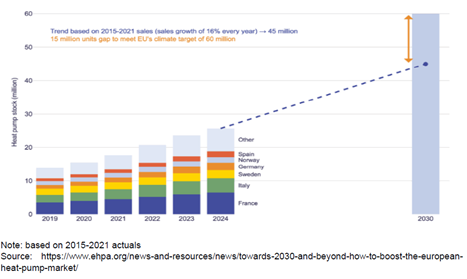

Heat pump installation is not developing as planned, see the following chart "Potential heat pump stock growth scenario in Europe (millions)" and the resulting installation gap to the planned value.

Gas remains the main source of space heating, but demand is not highly price-sensitive;

Development of the hydrogen economy is delayed. Planned sales are reduced;

Geopolitical tension and trade barriers remain;

The disruptive effects of high natural gas prices on individual gas-consuming industries are not reversible - consequently, these industries will not bring their production back to Europe.

Based on the assumed, very realistic, framework conditions, the following short and long-term (2040) demand for natural gas could result - according to the analyses by OIES. The base scenario with a natural gas price of rather > € 30/MWh is also shown. Note: the Y-axis does not start at 0 but at 400 bcm.

The short-term effects of a gas price of around €25/MWh are as follows:

Electricity sector: Limited additional demand for natural gas due to coal-to-gas conversion, as many coal-fired power plants have already been closed and the expansion of RES continues as planned - with the exception of offshore wind farms, where there are delays;

Industry: Slight recovery in gas demand due to economic uncertainty and global trade barriers as well as industrial production outflows that have already taken place;

Residential: Low gas prices could stabilise demand but not lead to a significant increase.

The long-term effects of a gas price of around € 25/MWh are as follows:

Power sector: possible - rather expected - delays in offshore wind expansion could increase gas demand by 10-16 bcm by 2035 despite large growth in RES but simultaneous, relatively strong increase in electrification;

Industrial: Limited recovery in gas demand as Europe will continue to face high energy and CO2 costs and the relocated industry will not bring its production back to Europe;

Residential: Low gas prices could slow down the switch to alternative heating systems, but not generate additional demand.