We take a look at the path from H2 hype to the realisation of a European hydrogen market

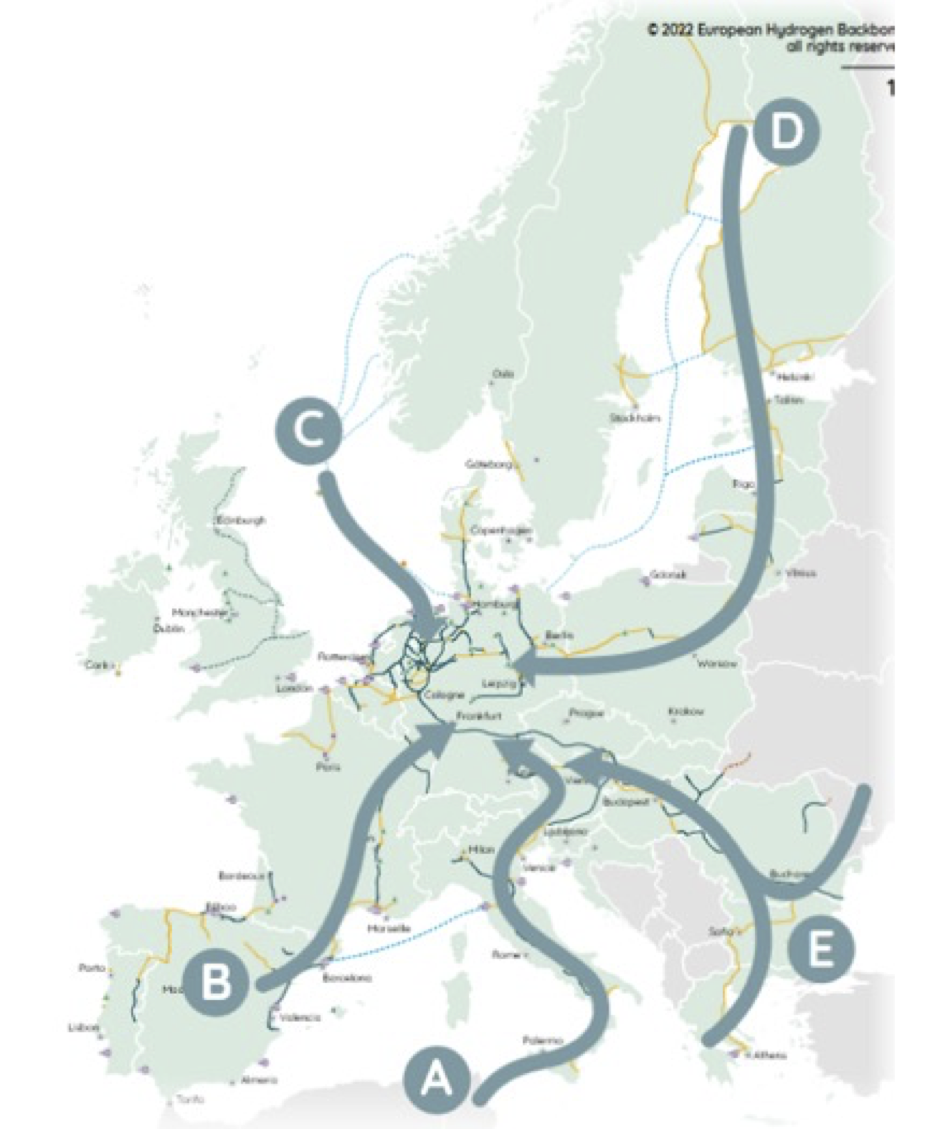

The hydrogen hype has led to the development of five pipeline projects to date, which are intended to ensure a sufficient supply of H2 in Europe, in addition to H2 production in the respective country. The aim is to create a European H2 market - partly analogous to the natural gas market - with both markets working in parallel during the H2 ramp-up phase. The diagram below, taken from European Hydrogen Backbone, schematically illustrates the 5 routes.

Money is made available for the development of these projects as part of so-called Projects of Common Interest (PCIs) - primarily for development and planning work - if the project is placed on the PCI list by the EC after the relevant criteria have been checked. Natural gas network operators usually develop such projects, which consist partly of new H2 pipelines to be built and partly of rededicated natural gas pipelines. What has not yet been explicitly analysed and assessed by the EC is the binding application or acceptance of the H2. For example, for the so-called "North Africa & Southern Europe" corridor (project A in the sketch) with an annual production volume of 4 million tonnes of H2/year, around €110 - 170 billion in investments would be required by 2030 in politically rather unstable countries such as Algeria, Libya or Tunisia - depending on which learning curve progress (progressive or conservative) is assumed. This sum is made up of the investments in:

- H2 generation - i.e. H2 generation industrial plants (electrolysers, piping, intermediate storage, measurement/control/regulation technology, land, etc.),

- Generation of electricity using RES and its connection, connection to the industrial plant, etc. The required output would correspond to approx. 4,400 wind turbines with an output of 10 MW each. This would require an area of approx. 2,500 km2 (comparison: Burgenland has an area of 3,960 km2). As already mentioned, we are talking about 4 million tonnes per year - a far cry from the 10 million tonnes per year announced by Prime Minister Meloni and Federal Chancellor Scholz around a year ago.

It is clear that the production of H2 in North Africa - but also elsewhere - requires very high levels of investment. Investment protection agreements could provide some of the guarantees required by potential investors - thus accelerating investment. Taking this perspective into account, it is clear that the transmission system operators, who are undoubtedly full professionals in this respect, would almost certainly provide their part of the supply chain - probably with a slight delay - but this is "only" the midstream part. For a successful, timely H2 ramp-up, it would probably be more beneficial to analyse the entire supply chain and view it as a package - i.e. including a binding supply (upstream) and the associated, contractually agreed offtake (downstream).

The overall package would facilitate the financing of the upstream, midstream and downstream side and make infrastructure utilisation tariffs, including H2 storage utilisation fees, cheaper - possibly based on an intertemporal cost shift. This is against the background of already high H2 production costs - which unfortunately will not fall as quickly as was expected during the H2 hype period and which formed the basis of the project calculations at the time.