Hopes for a solution to the trade conflict and new EU plans lead to movement on the natural gas market

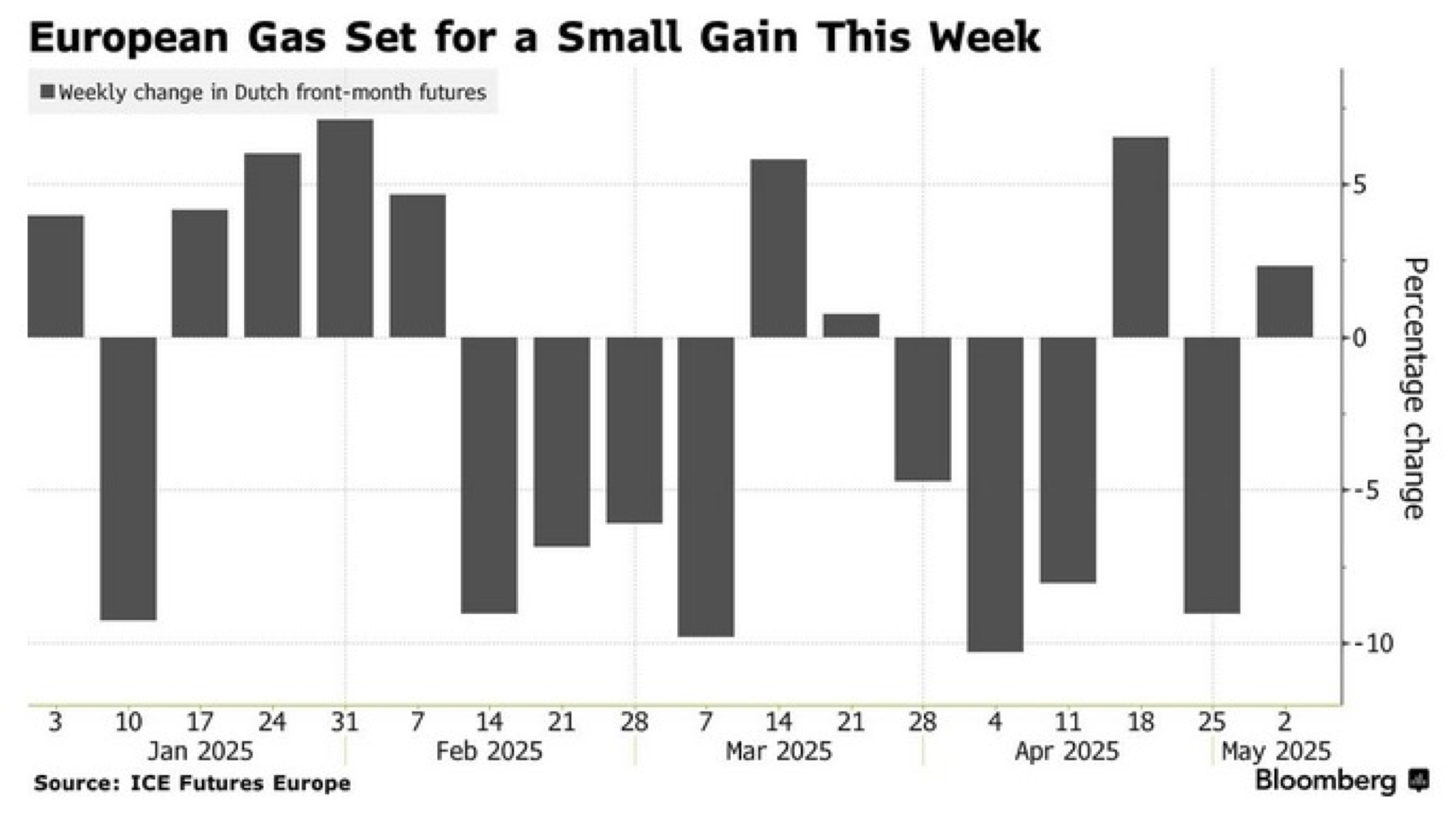

After China signalled its willingness to talk about settling the trade conflict with the US, natural gas prices rose considerably on 2 May 2020 - as a result, the losses of the previous days have been partially "made up". Futures rose by around 2% on a weekly comparison basis - see the chart below, taken from Bloomberg.

Since the USA introduced a series of tariffs, the price of gas has fallen by around 20% within a month. Oil prices have also fallen by around 20% since Liberation Day. This shows that the fear of serious trade conflicts is weighing on the economy, particularly the Chinese economy, and consequently depressing demand for energy, as described in some of the previous articles published here. A medium-term decline in demand for natural gas in China would "relieve" the tight LNG market by around 13 billion Nm3 per year.

Hopes that the trade dispute between China and the USA will soon be resolved have caused natural gas prices to rise relatively sharply, but can this hope be realised in the short term? Probably not, as China will endeavour to establish watertight, long-term regulations in the negotiations that are to take place - if they are held soon - in order to prevent erratic practices that are detrimental to a well-functioning economy in the future. This is against the background that there will probably also be poker for power, loss of face and personal vanity - so it is to be expected that the contract negotiations will take a long time and therefore the demand for natural gas in China will not increase so quickly.

From this perspective, Friday's significant countermovement to the falling natural gas prices of recent weeks appears to be somewhat exaggerated - especially as the legally stipulated natural gas storage refill rate will be relaxed in terms of timing and volumes, which could take some additional "pressure off the boiler" and thus reduce any price rises.

Taking into account the EU plan - which, according to today's Bloomberg report, is to be proposed in June 2025 - to stop all natural gas imports from Russia at the end of 2027, the results of the analyses are different - particularly from a short and medium-term perspective as, according to the alleged proposal, new import contracts and existing spot contracts are to be stopped as early as the end of 2025. As spot contracts account for around 1/3 of imports from Russia, an additional supply gap could arise from the beginning of 2026 that would have to be closed by other LNG imports. According to Bloomberg, further details of the plan will be announced on 6 May 2025, i.e. tomorrow. Whether the supply gap can be closed without significant price increases depends on whether the announced LNG liquefaction projects, primarily in the USA, come online on time and with the corresponding capacity - taking into account the ramp-up phase - and whether major technical faults occur at the existing liquefaction plants.