If the proverbial bicycle falls over in Beijing, then we do care!

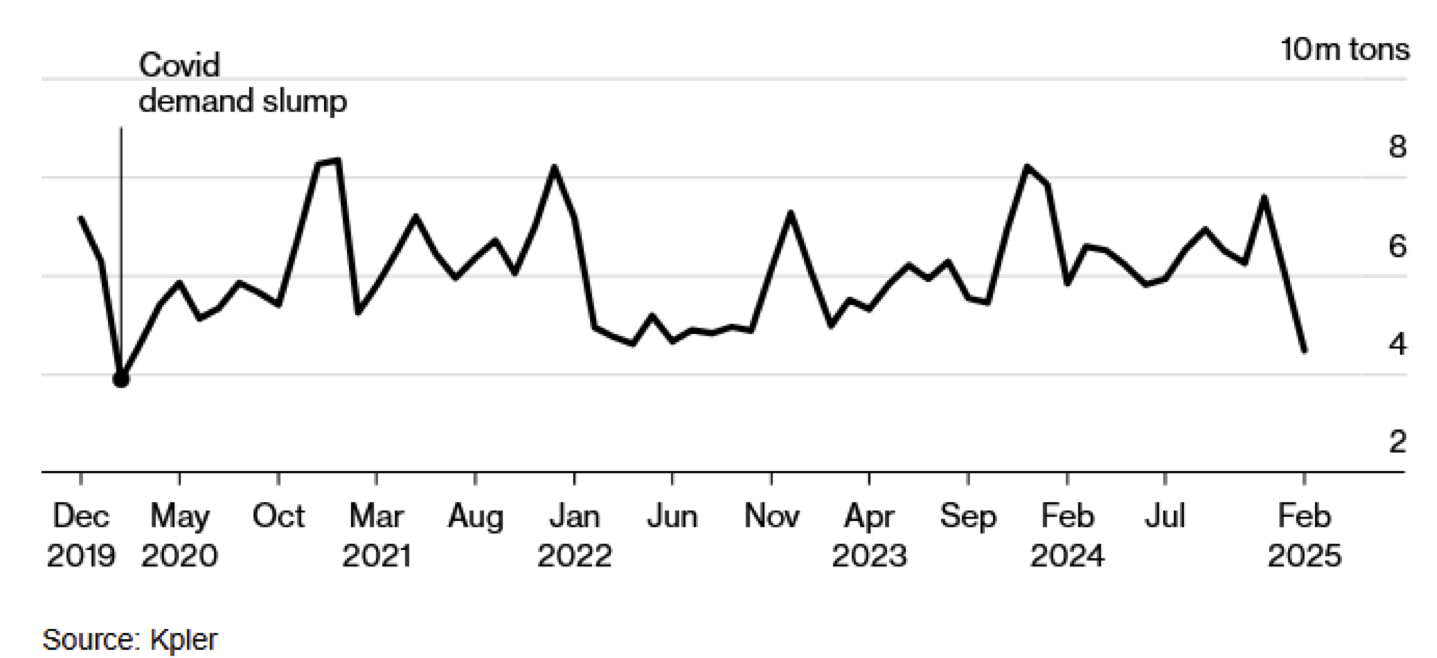

The consolidation and interpretation of energy-relevant data for China gives reason to hope that natural gas prices in Europe will continue to fall - even during the refilling of storage facilities in 2025. According to Kpler's data, China took as little LNG in February 2025 as it did at the beginning of 2020 - i.e. during Covid times in China - see chart below.

Rystad Energy China believes that the winter was warm and that industrial demand was also relatively low. The "overfilled" storage facilities will have an impact on LNG offtake in China until the end of the heating season. Some Chinese gas suppliers have resold spot cargoes to Europe in order to benefit from the high European prices.

If we now take into account the fact that China has now imposed tariffs of 15% on LNG imports from the USA, then a number of LNG cargos will probably be "diverted" to Europe in the near future for price reasons.

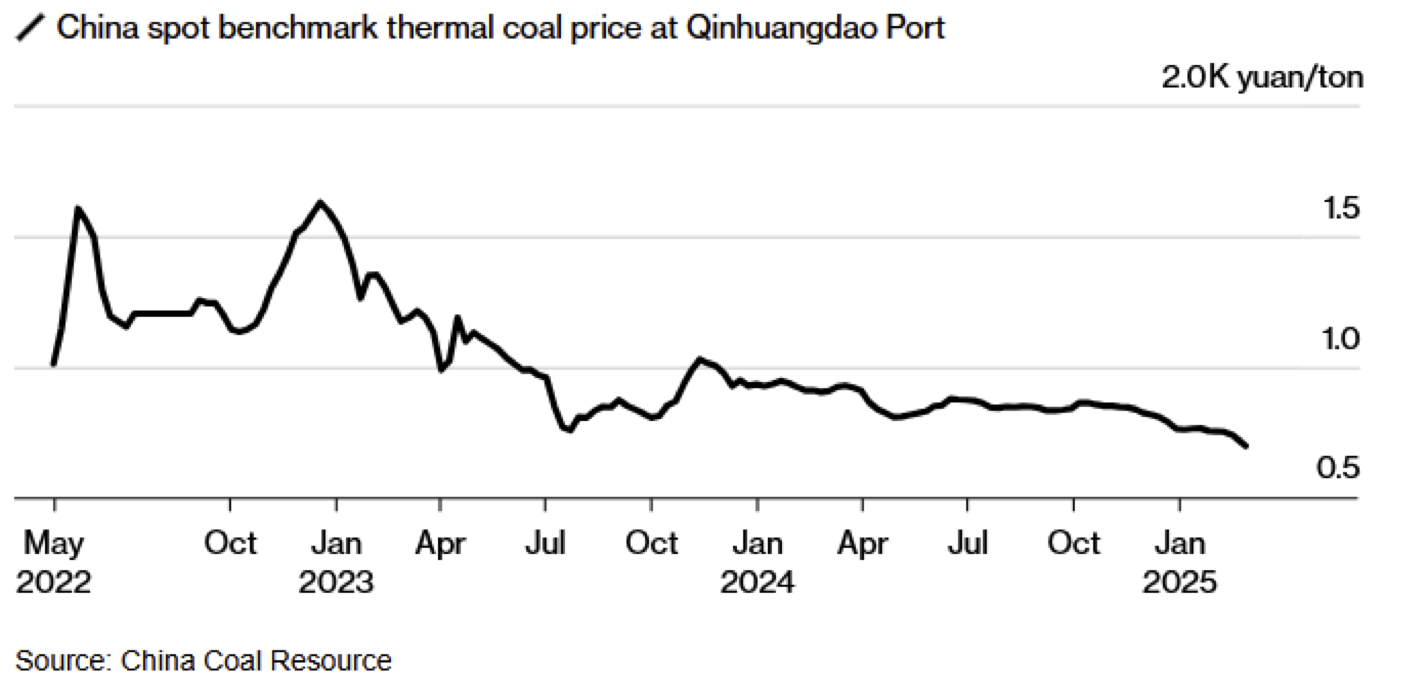

In addition, the news that China could possibly reintroduce import controls on coal due to the oversupply, which is manifested in the sharp drop in coal prices (see chart below), deserves a lot of attention.

An outright import ban is unlikely due to the country's membership of the World Trade Organisation (WTO), but non-tariff barriers, such as excessive inspections of imports or deliberate delays, could be introduced to enforce a kind of de facto import ban.

China had an import cap of 300 million tonnes in force until 2022. This measure was subsequently suspended for reasons of supply security. Last year, 543 million tonnes were purchased abroad. As the demand for coal remained far below expectations and is currently still falling, prices are also having a negative impact on the profitability of Chinese coal mines. For this reason, mine operators are to control output and the mining of low-quality coal is to be restricted

If these facts are put into context, the result could be a picture of a weakening economy in China - i.e. below the planned growth rates. This would mean that the demand for LNG in China in 2025 could be lower than planned, meaning that the global LNG market, which is of great relevance for refuelling European natural gas storage facilities, would not be quite as tight in the future - not even in the summer of 2025. This conclusion points to a relatively rapid and significant drop in gas prices - especially as temperatures in Europe are getting warmer and consumption is falling. This trend appears to have already started and is likely to continue.