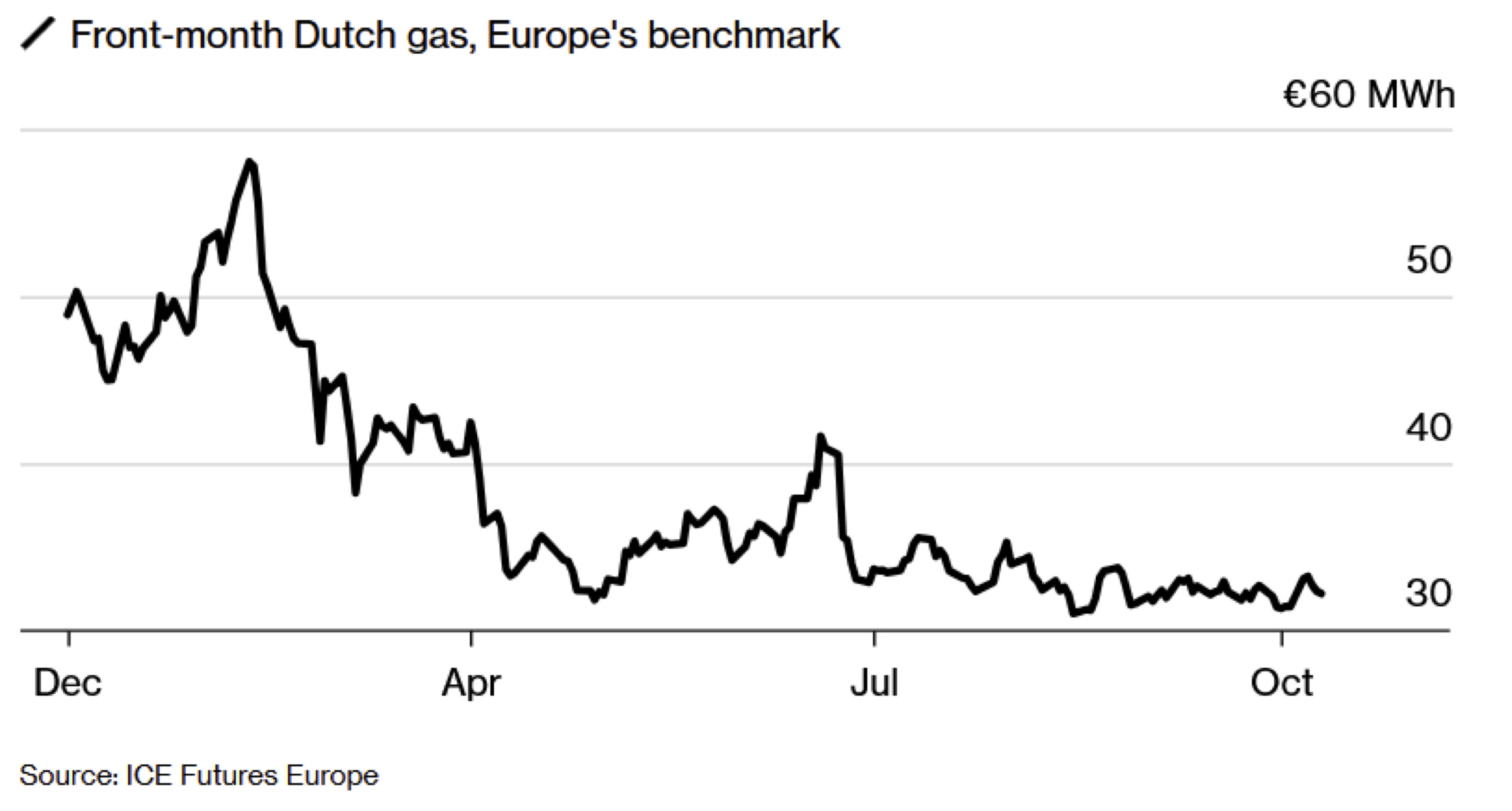

Natural gas prices on the TTF have returned to the range in which they traded for weeks - see the chart below, taken from ICE Futures Europe. After rising briefly at the beginning of the week, prices have fallen for three days in a row. A relatively early cold snap has increased the need for heating in parts of the EU and some weather models are forecasting below-average temperatures in the coming days.

Traders are waiting for further indicators regarding the course of the heating season, the filling of natural gas storage facilities and possible political guidelines regarding the withdrawal from Russian fossil fuels.

Although the EU has succeeded in raising the natural gas storage level to just under 83% (data available today) relatively quickly, it is still slightly below the historical average. This is due to the fact that the last heating season led to a strong depletion of natural gas storage facilities. As of today, Austria has reached a natural gas storage level of 85%.

Although the EU is currently "tightening" natural gas supplies, traders appear to be a little unsettled based on their experience of how the EU deals with prolonged peaks in demand.

LNG flows to Europe's north-western LNG regasification terminals have increased, especially as increased supplies of Russian gas to China are making slightly more LNG gas available to other buyers.

Nevertheless, the brief price rise earlier this week appears to have sparked renewed interest in the European gas market - after weeks of largely stable movements had limited profit opportunities. According to data compiled by Bloomberg from the Intercontinental Exchange, aggregate open interest in benchmark gas contracts rose to an all-time high this week, indicating increased liquidity in the market.